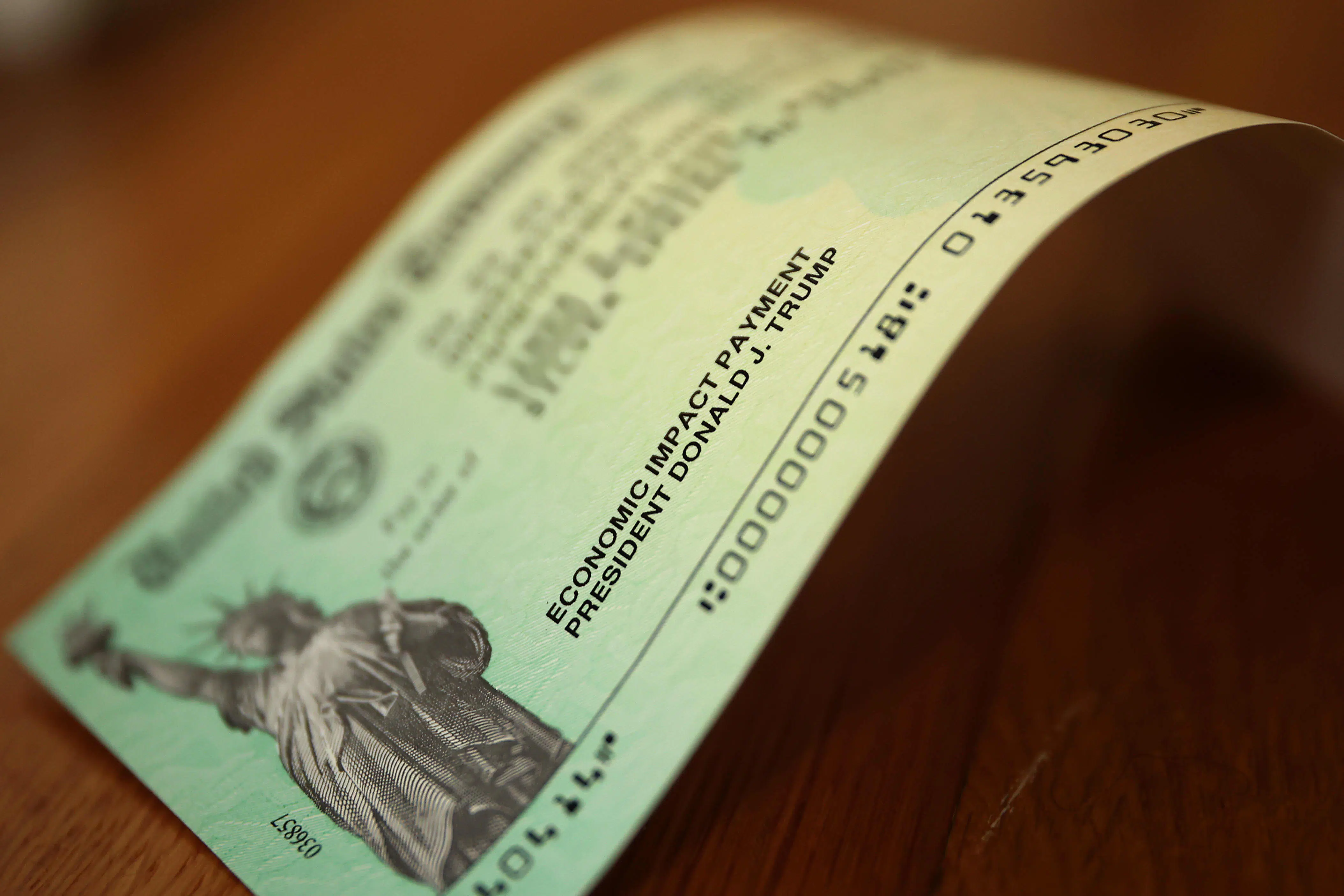

Reports that the government is mailing out five million stimulus checks every week. If things continue at this pace, some may only see their check arrive in a few months. Thus, it means that it’s going to take some time for the organization to distribute checks for the millions of American citizens who are programmed to receive them in the mail.

In the case that your payment isn’t deposited straight into your account, the IRS will mail you an actual check. The IRS’s intention is to get the financial stimulus to those who really need it. As a consequence, those with lower incomes will get the money sooner. At the same time, this also signifies that higher-income households are further down the line to receive their check. Those who earn above US$190,001 will have to wait until September.

However, the posting of stimulus checks to citizens getting RRB benefits or Social Security is already happening. The government will work with data from the administration of Social Security, or RRB, to adjust your check. Except if you did a tax return for 2018/19. Then, automatically, they will deliver the stimulus to you.

On stimulus checks and late delivery

People that don’t file their taxes will get their money via debit card, direct deposit, or check, i.e., in the manner they usually collect benefits from the government. For people receiving SSI or veterans’ benefits, similar rules are in place. However, they won’t receive their payments until at least the middle of May. At least if they didn’t file a tax return for 2018 or 2019.

The government already scheduled you to receive electronic payments if in your 2018/19 tax return you choose a refund through direct deposit. In the majority of other situations, you’re likely to receive an actual check. Nevertheless, even if you are, there is still the possibility to ask for the direct deposit option.

In the case that you did a tax return report for income in 2018/19 but didn’t choose the bank deposit, or didn’t receive a refund, enter the IRS’s “Get My Payment” website and check if there is still time to present your bank info and receive electronic payments.

Read Too:

Axis Bank Personal Loan – Best Payment Terms

If you need more information, check the ‘Where’s My Stimulus Check?’ Or use the IRS’s “Get My Payment” Portal to figure it out. If you don’t have to register your taxes, enter the IRS’s “Non-Filers: Enter Payment Info Here” page to provide the information the IRS needs to send your stimulus support.

Generally, you don’t have to enter the segment for non-filers if you get the benefits from the government noted here. If your stimulus payment isn’t deposited directly into your bank account, the IRS will send you a paper check in the mail. They’ve already started sending out paper checks, so you could get stimulus checks at any time now.