Anúncios

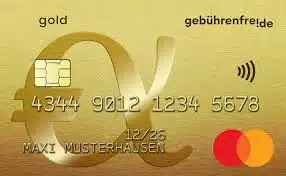

Gebührenfrei Mastercard GOLD is an attractive option for those seeking convenience and flexibility in their financial transactions. Simple and affordable application requirements offer viable options for a wide range of users.

In addition, it is widely accepted around the world and includes benefits such as travel insurance and installment payments, making it a convenient option for consumers who value security and convenience.

Anúncios

However, it is important to be aware of the limitations and fees that may be associated with the card and to make an informed decision before applying. Overall, the Gebührenfrei Mastercard GOLD is an attractive option for those looking for a reliable credit card full of advantages.

The combination of affordable features and convenient benefits makes it a choice that meets the financial and lifestyle needs of many users, providing convenience and security in everyday transactions.

Features of Gebührenfrei Mastercard GOLD

The new free Gebührenfrei Mastercard GOLD comes with a range of great features that make it a lucrative choice for everyday spending and travel.

Anúncios

An interest-free lifetime payment period of up to 7 weeks gives you the financial flexibility to manage your spending with peace of mind, without worrying about additional charges.What’s more, there’s no annual fee, so you can make the most of your card at no extra cost.

With free access to more than 1.7 million ATMs and 35 million acceptance points worldwide, Mastercard Gold offers unrivaled transaction convenience, with no additional fees on foreign transactions.

You can easily use your card wherever you are, without worrying about additional costs, making international travel and shopping more accessible and convenient.

Gebührenfrei Mastercard GOLD includes comprehensive travel insurance for peace of mind while you travel. If you have any questions or need assistance, our customer service is always available.

Plus, you’ll benefit from a 5% travel credit with our Best Price Guarantee to help you make the most of your trip. In addition, the 5% car rental refund saves you even more money on transportation, making your experience even more rewarding and economical.

With Mastercard Gold, you enjoy financial convenience and flexibility, as well as a range of additional benefits that make your trip even more enjoyable.

Advantages of Gebührenfrei Mastercard GOLD

Gebührenfrei Mastercard GOLD offers a financial experience without additional fees, guaranteeing transparency and savings on transactions.Whether it’s everyday purchases or trips abroad, you don’t have to worry about extra costs and can manage your finances more efficiently.

What’s more, this card already includes comprehensive travel insurance, giving you peace of mind as you venture around the world. With insurance cover ranging from medical assistance to baggage loss cover, you can travel with peace of mind knowing that you’ll be covered should anything unexpected happen.

Another notable benefit of Mastercard Gold is the installment option, which gives you flexibility in managing your spending.Split payments allow you to adapt your finances to your needs, making it easier to manage your budget and cash flow.

In addition, applying for the card does not require changing banks, so you can enjoy all the benefits without interrupting your current banking services.With these features and conveniences, the Gebührenfrei Mastercard GOLD is a smart choice for those looking for functionality, security and financial freedom in a single card.

Disadvantages of Gebührenfrei Mastercard GOLD

Although the Gebührenfrei Mastercard GOLD has some advantages, it is important to also consider the possible disadvantages.One is that depending on the issuing bank, there may be minimum income requirements to qualify for the card.

This may limit access for some people who don’t meet these financial criteria.Also, although travel insurance is included, certain events may not be covered, so it’s important to read the terms and limitations of your policy carefully to ensure that it meets your specific needs.

Another disadvantage to consider is that although partial payments are a convenient option, interest may be charged on amounts not paid in full each billing cycle.

This means that if full payment is not made and the balance is not paid on time, you could incur additional financial charges.In addition, although you don’t have to change banks to apply for Gebührenfrei Mastercard GOLD, the services offered by your card issuer may vary and affect the customer experience, depending on your specific needs and banking preferences.

How to apply to Gebührenfrei Mastercard GOLD

To apply for Gebührenfrei Mastercard GOLD, first find a bank or financial institution that offers the card.Review the policies, fees and associated benefits to find the option that best suits your needs.Make sure you meet the minimum requirements, such as minimum age, proof of income and place of residence.

Then fill in the credit card application form with your personal information and necessary documents, such as proof of identity, residence and income. Wait for your card issuer to review and approve your application.

This can take some time.Once approved, you will receive your card in the mail and can follow the instructions to activate it. Before applying, read the card’s terms and conditions to fully understand its benefits and responsibilities.

Requirements of Gebührenfrei Mastercard GOLD

The application requirements for Mastercard Gold are accessible and easy, providing an efficient experience for potential customers.

Generally, you must be at least 18 years old, as determined by the issuing bank. In addition, applicants must demonstrate a stable source of income to ensure they can afford the costs associated with the card.

While complying with legal and regulatory requirements, it is also important that you reside in the region where your card issuer operates.

It is important to note that although these rules are general, they may vary depending on the bank’s internal policies.

Conclusion

Gebührenfrei Mastercard GOLD is an attractive option for those seeking convenience and flexibility in their financial transactions.Simple and affordable application requirements offer viable options for a wide range of users.

In addition, it is widely accepted around the world and includes benefits such as travel insurance and installment payments, making it a convenient option for consumers who value security and convenience.

However, it is important to understand the potential limits and fees associated with the card and make an informed decision before applying. Overall, the Mastercard Gold is an attractive option for those looking for a reliable credit card full of advantages.

You will be redirected to the official website.